The suit regarded the advising LeBoeuf gave General American Life Insurance Co. in 1999. Apparently the dispute regards Alexander Dye, a lawyer for LeBoeuf who improperly advised General American Life Insurance to sell itself at a discounted $1.2 billion to MetLife.

LeBoeuf argued for and settled that it has provided “sound and appropriate legal advice” and that MetLife in fact overpaid for General American.

Meanwhile, Dye is no longer with Dewey and & LeBoeuf. He changed up for Willkie Farr & Gallagher in March.

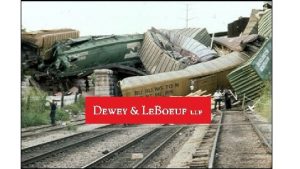

It is difficult to see what a $3 billion suit would mean for Dewey, who can barely pay their own bills, let alone their staff, and have been downsizing their company and giving many of their employees the opportunity to seek alternative employment. One of the latest episodes of the Epic tragedy of Dewey and LeBoeuf is their possible decision to seek bankruptcy after all, to protect some of their assets. They have previously hoped to settle their debts without such recourse.