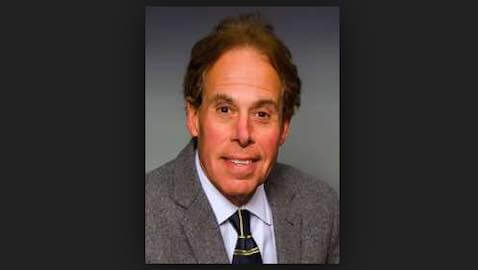

Summary: William Uchimoto, who is facing civil charges from the Securities and Exchange Commission, has stated that he is “shocked” by the allegations.

According to the Legal Intelligencer, William Uchimoto was “shocked” when he found out about the U.S. Securities and Exchange Commission’s civil securities fraud charges against him. Uchimoto used to run the China practice groups for Buchanan Ingersoll & Rooney and Stevens & Lee. The charges were brought on September 10.

Uchimoto is also a former general counsel to the Philadelphia Stock Exchange. He insisted that everything he did regarding the questioned Nasdaq listings was “perfectly correct” and was in line with advice from Nasdaq staff.

The charges were brought as a result of a joint investigation by the SEC and the Department of Justice that looked into the investment activities of China stock promoter Benjamin Wey. Wey and a few others are facing criminal charges in light of allegations that they caused companies to be listed on U.S. stock exchanges and that they manipulated the ownership of stock so that they could pocket millions of dollars. According to the American Lawyer, Wey’s wife, sister, and broker have also been charged. However, Uchimoto and Robert Newman, another attorney, were charged civilly for apparently helping the others with at least some of their efforts.

Uchimoto departed Stevens & Lee in February to open his own firm. News of the charges was a shock, since it had been over a year since he had last communicated with the SEC over the investigation. He also had no warning that the complaint was being filed, although the SEC usually provides some sort of notice.

Earlier this year, Wey was a defendant in a sexual harassment trial.

The complaint alleges that, in 2008 and 2009, Uchimoto helped two clients of Wey’s company, New York Global Group, get on Nasdaq. The SEC argues that Uchimoto provided misleading statements to Nasdaq staff in response to questions about whether the companies had the required number of shareholders. Uchimoto supposedly provided a new list of shareholders to Nasdaq that allegedly met those requirements, but the SEC complained that the list covered up the fact that osme of the questionable shareholders, meaning those who were gifted shares instead of making investments, were included.

However, Uchimoto claims that he was only providing information that he was given by his client.

Uchimoto explained, “We did everything at Buchanan perfectly correct for those two companies. It makes it look like I initiated all the plans. … We were advisory and reactive.”

Uchimoto argued that he filed the investors list that the clients gave him. Nasdag had questions about the list, and Uchimoto states that he investigated and told Nasdaq that some of the investors had been gifted shares of stock. Uchimoto said that Nasdaq told him that the rules were not clear as to whether giftees could be included as investors to meet the limited number of investors requirement. He said that he was informed that giftees could not be included.

Uchimoto said that he then asked for advice from Nasdaq as to how he should proceed, and he later provided a new list that supposedly met the requirements.

New SEC rules will also affect clawback policies.

However, the SEC claimed that the shares were put into “street names,” which means that they are deposited into brokerage firms, and the brokerage firm is subsequently listed as the owner. The SEC argued that some of the shares were the gifted ones that should not have been included.

Uchimoto said, “Everything was done appropriately and in good faith and in accordance with Nasdaq advising us. I’m shocked.”

William DeStefano, the attorney who represented Uchimoto during the SEC investigation, said that Uchimoto was involved in the government’s attempts to build cases against larger targets and as part of the SEC’s goal of targeting more individuals.

DeStefano added that he worked with Uchimoto at Saul Ewing, Buchanan Ingersoll and Stevens & Lee. He said that Uchimoto was a “good guy” whose supposed role in the scheme was “very minor.” He remarked, “From the investigation and also from reading the complaint, I think it is a very iffy case or a very thin case against Bill.” CNBC adds that Wey’s bond for his criminal charges was $10 million.

DeStefano remarked that the investigation had been ongoing for about two years. He said, “Frankly, I thought, having heard nothing from the SEC for a better part of a year, maybe even more, I thought it was over.”

The SEC has investigated threats Wall Street may face due to cyberattacks.

DeStefano commented that the SEC does not usually go after attorneys, but that there is a new enforcement plan in place in light of the recession and the stock market crash. He said that the SEC has gone after more individuals than entities as a result.

DeStefano also said that the list of investors could have been altered by the client without Uchimoto’s knowledge. “Where is the fraud there? Is the lawyer obligated to do his own due diligence to make sure the client is being truthful?”

Source: The Legal Intelligencer

Photo credit: thetrustadvisor.com, ChambersandPartners.com (DeStefano), caucus2009.nushkba.org (Uchimoto)