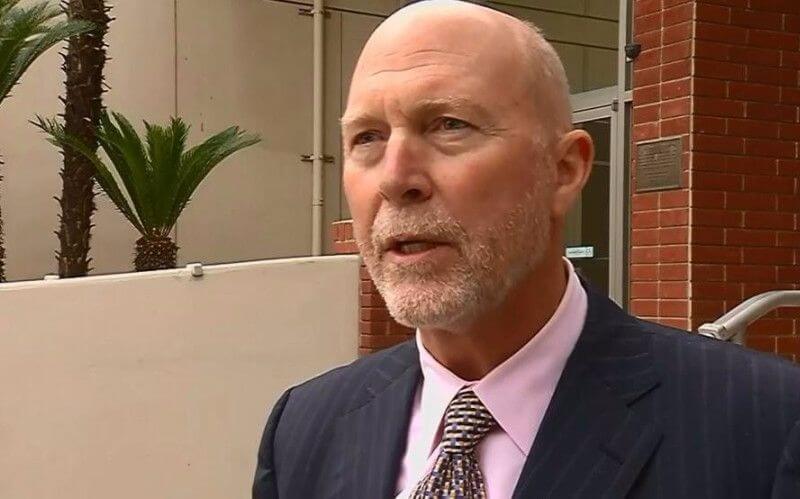

Summary: Bakersfield attorney Phil Ganong and his wife are charged with multiple counts of insurance fraud with a sentence if found guilty up to 50 years.

Authorities have charged a Bakersfield, California attorney in a multi-million medical insurance fraud scheme. Phil Ganong owns a series of sober-living homes was accused alongside his family and two doctors in a scheme involving excessive urine testing.

Ganong adamantly denies the dozens of charges from the Orange County District Attorney’s Office. If found guilty, he faces roughly 50 years in prison. The charges allege that he spearheaded a scheme involving insurance fraud, money laundering, and conspiracy to commit medical insurance fraud. His wife Pamela, son, sister-in-law, and two Southern California doctors were also charged for their roles in the $22 million scheme. The doctors were charged for allegedly writing unnecessary urine test orders in exchange for money.

Ganong owns, with his family, sober living homes through their company William Mae Company under the name of Compass Rose Recovery throughout Orange County, Bakersfield, San Diego, and Los Angeles. In a press conference, Ganong said, “We adamantly deny these charges. We are prepared for this fight and have been preparing for almost four years.” Anthem Blue Cross first raised suspicion over the insurance claims four years ago, asking Orange County prosecutors in look into his toxicology laboratory.

The District Attorney’s Office determined that the Ganong family operates a number of businesses, including a medical testing lab and staffing agency. They claim that the staffing agency is a “front to overbill insurance companies” by registering employees and requiring them to supply daily urine tests. They believe the six defendants collected $15 million from $22 million over four years of fraudulent bills.

Many of the supposed employees were apparently residents of the sober living homes. Ganong argues, “The employees of these companies were real, paid real wages, real withholdings, real taxes and provided with real health insurance.” He explains the frequent urine tests as a way of keeping their sober-living residents clean.

Ganong explained, “While these charges are unwelcome and unpleasant, they are not unexpected, given the health insurance industry’s mission to interfere with and control the delivery of health care services.”

Residents of the sober-living homes were recruited by other Compass residents by word of mouth and through Craigslist. After operating for four years, the company had 12 employees on their payroll and health insurance company benefits. Prosecutors allege that the Ganong’s listed residents as some of their employees as well as non-residents, expanding their health insurance policy to cover up to 100 employees.

A year later in 2013, they allegedly started a temporary labor agency called Compass Rose Staffing. They then enrolled their residents and non-residents on the payroll and started requiring almost daily urine tests. Their medical testing lab was called Ghostline Labs. The prosecutors then claim that the Ganong’s went on to change insurance carriers four times to avoid detection.

Ganong and Pamela each face a maximum 47 years and eight months in prison. They are charged with conspiracy to commit medical insurance fraud, 26 counts of money laundering, and 13 counts of insurance fraud. The others charged are 33-year-old William Ganong, 63-year-old Susan Lee Stinson, 61-year-old Dr. Carlos X. Montano, and 70-year-old Dr. Suzie Schuder. Stinson is Pamela’s sister.

Montano and Schuder were allegedly given 20 percent of the net insurance proceeds from the urine tests plus a per-patient fee of $200.

Do you think insurance companies try to find ways of not paying out claims? Tell us in the comments below.

To learn more about attorneys involved in fraud schemes, read these articles:

- “Conn-Attorney” Pleads Guilty to Fake Disability Benefits Scheme

- Trial Finds New Jersey Lawyer Guilty of Fraud

- Ohio Personal Injury Firm Sued for Allegedly Frauding Clients

Photo: bakersfieldnow.com